Two historic preservation tax credit programs are available for historic properties rehabilitated within Missouri. Established in 1976, the Federal Historic Preservation Tax Incentives Program provides federal income tax credit to private property owners for qualified rehabilitation projects of certified historic buildings. In 1997, Missouri created the Missouri Historic Preservation Tax Credit Program, a similar incentives program that encourages the preservation and continued use of Missouri’s historic architectural resources.

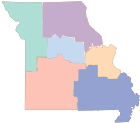

Today, through the Federal Historic Preservation Tax Incentives Program, privately owned income-producing properties determined to be certified historic structures may receive a 20% tax credit for the cost of qualified rehabilitation expenditures. The Missouri Historic Preservation Tax Credit Program provides a 25% tax credit for rehabilitation of certified historic structures in St. Louis and Kansas City, and a 35% tax credit if the property is located outside of St. Louis and Kansas City and does not receive or intend to receive STATE low-income housing tax credits. (It is OK to have a 35% MO HTC project with FEDERAL 4% or 9% MHDC-awarded LIHTCs.) The state credit is available to both commercial properties and owner-occupied homes.

Projects that qualify for both the federal and state programs may apply for both, bringing the total tax credits to 45% in St. Louis and Kansas City, or 55% outside those two cities. As per state legislation that took effect in August 2024, nonprofit entities are eligible to participate in the state program; they are still ineligible to participate in the federal program. Government entities are ineligible to participate in either the federal program or the state program.

Federal Historic Preservation Tax Incentives Program – How to Apply

Missouri Historic Preservation Tax Credit Program – How to Apply

For a detailed comparison of the federal and state HTC programs, refer to this FAQ sheet.

Consultations

Prospective applicants are strongly encouraged to meet with a member of the SHPO’s Architectural Preservation Services (APS) section prior to submitting an application. Members of the APS team provide technical review and guidance related to both federal and state HTC projects, as well as other programs instituted under the National Historic Preservation Act. Primarily, the APS team works with property owners, architects, developers and preservation consultants to ensure that rehabilitation projects qualify for historic tax credits in accordance with the Secretary of the Interior’s Standards for Rehabilitation.

Virtual and in-person consultation meetings for applicants and their team members are available every Tuesday afternoon and Thursday morning by appointment.

- Consultations include pre-application reviews and technical guidance. Consultations may also be arranged to address questions related to projects that are in progress.

- SHPO response to a consultation is advisory – i.e., guidance limited to the specific issue(s) requested and the related information provided. It is not a determination and is non-binding. Formal determinations are provided following the formal review of an entire scope of work in a state and/or federal application.

- The facts, circumstances and understanding of a project may change between the time of a preliminary consultation and the submission and review of a federal Part 2 or a state Part 1 application.

- Preliminary consultation responses are generally provided verbally.

- Preliminary consultations are not a substitute for an understanding of the Secretary of the Interior’s Standards for Rehabilitation or the use of preservation consultants.

To schedule a consultation, please call the APS team at 573-751-7860.

All applicants to the federal and/or state Historic Tax Credit programs are advised to wait for signed approval on their proposed scope of work before undertaking any demolition or construction work on the project. Any work performed without signed approval is done at your own risk. If you perform work that does not meet the Secretary of the Interior’s Standards, it can have financial consequences at the end of the project.